M&A Insights and News

Coaching of the Sale of Boch AG | 6.7.2021

We are pleased to have coached Mr. Christian Hipp who is staying with the company in his successful sale to G. Kolly SA of French speaking Switzerland in a transaction structured over several phases.

We are pleased to announce that we have entered into a strategic partnership with Hoffmann & Partner, Basel.

In September 2017, the team members of Jürg Kurmann Mergers & Acquisitions AG founded the start-up company Nimbo AG which offers owners of small and medium sized companies an innovative web-based valuation tool. Nimbo currently performs more than 800 online valuations per month. Read in our current interview with Marc Uhlmann, co-founder and managing director of Nimbo AG, what makes Nimbo special and which business model Nimbo pursues.

Pemsa SA, Lutry, expands further into German speaking Switzerland with the acquisition of MBT AG, Zürich. This is the second transaction Jürg Kurmann M&A has advised Pemsa on.

-> Read more on this transaction

Dr. René Ziegler worked for Novartis from 1980 to 2015. He started his career in research at Sandoz as Head of Cardiovascular Research and then as Global Head of Discovery and Technology. With the merger of Sandoz and Ciba-Geigy to Novartis, he was appointed manager of the IT integration of research.

Schaer Pharma. Itingen, acquires human OTC products and the pertaining international distribution business from Dômes Pharma in an asset deal. Jürg Kurmann Mergers & Acquisitions AG has identified the transaction opportunity and has advised the buyer in the negotiations.

Read in our interview with Dr. Frank Brinken, Vice-Chairman of the Board of Starrag Group Holding AG, why CEOs should not be members of their Boards and why after their tenure they should enter

the Board but not become directly Chairman, and why he expects an increasing M&A activity in the machine tools industry because of digitization.

-> Interview with Dr. Frank Brinken

Unafortis, a Swiss based wealth management consultancy and IT services firm is one of the leading Avaloq implementation partners. Luxoft is a globally leading provider of software development services and IT solutions.

Pemsa SA, Lutry, expands further into German speaking Switzerland with the acquisition of Tiro Personal AG, Zürich. Jürg Kurmann M&A in Basel advised Pemsa on this transaction.

The interview with Renato Chiavi about his career from a forwarding apprentice to the CEO of Deutsche Post Global Forwarding, his most important success factors for creating the forwarding world market leader and why he returned from retirement in 2015 to answer in next to no time around 1’000 emails from employees.

Matthias Waehren was CFO of Givaudan from 2005 until the end of 2016 and is now in charge of various strategic special projects. During his tenure as CFO, Givaudan has realized one very large and - especially more recently - several smaller acquisitions. Givaudan is the leading industry consolidator in the field of Flavors and Fragrances („F&F“)

SunTechnics Fabrisolar has been acquired by the Elektrizitätswerke Zürich (“ewz”). Jürg Kurmann Mergers & Acquisitions has advised the sellers. SunTechnics Fabrisolar offers engineering and realization of solar solutions across Switzerland with locations in Zurich and Rolle. Ewz strengthens with this acquisition its newly formed business unit Energy Solutions.

Ueli Dietiker was Swisscom CFO and Deputy CEO; today he still works 60% for Swisscom and as Board member at Fastweb, Belgacom International Carrier Services and Cinétrade. He serves also on the Boards of Zuckermühle Rupperswil, Sanitas, Wincare, Swisslife and BLS and is member of the Foundation Board of Renaissance KMU Schweizerische Anlagestiftung.

-> Read here about Ueli Dietiker's success factors and his most surprising M&A incident

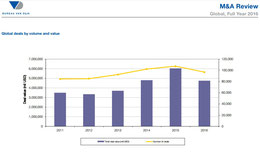

While the global count of transactions as recorded by the M&A database provider Bureau van Dijk has been receding in 2016, the count of transactions involving Swiss target companies has increased from 941 transactions in the year 2015 to 1‘269 in the year 2016.

-> This link gets you to the PDF with the full report 2016 with the global data

The EBIT-Multiples in the Small Cap segment (up to CHF 50 million revenues) as estimated by the expert panel of the Finance Magazin showed a heterogeneous development across the various industries in the second half of 2016. While some industries recorded overall lower multiples, several industries recorded at the same time a higher upper limit of the spread and a lower lower limit. Overall higher multiples have been recorded for the industries Software, Media, Vehicle Manufacturers and Supply Industry, Machine Industry, Chemicals and Cosmetics as well as Pharma.

-> This Link gets you to the PDF with the November/December 2016 multiples